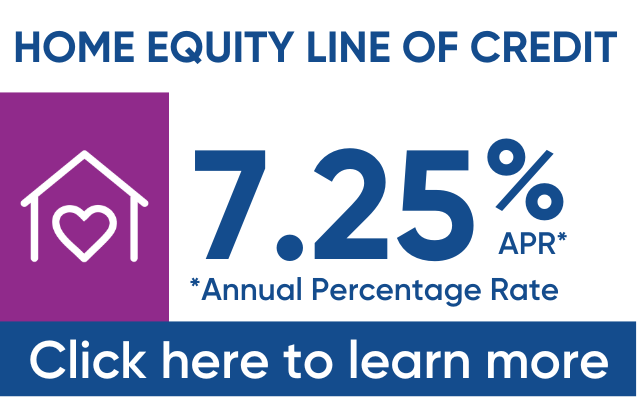

For more savings, check out our low Home Equity Loans and Line of Credit

Celebrate our Grand Opening with Grand Deals

Personal Loan (Rates as low as 7.49% APR1)

Whether you need to consolidate credit card debt, pay off holiday bills, pay your taxes, buy gifts for special occasions, or take the family on vacation, our Personal Loan is ready for you. This loan features:

- Terms up to 60 months

- Up to $20,000 maximum

- Competitive Fixed Rates

- Tuition Assistance (for parents)

- Low-cost payment protection available

- Easy process - apply online 24 hours a day, 7 days a week, visit any branch office, or call 1.800.CR.UNION to speak to a Loan Officer

Open a Connex Consumer or Business Checking Account and receive a $350 Bonus2

All Consumer Checking Accounts Feature:

- Free VISA® Debit Card

- No Minimum Balance

- Access to Connex ATMs and 55,000+ All Point® ATMs Nationwide

- Free Online Banking, Mobile Banking, Bill Pay, and External Transfers

- Free Online Check Images

- Free Smart Score Credit Score Range

To learn more about Connex Consumer Checking Accounts, Click Here

As a small business, we know you need a checking account that is flexible and doesn't slow you down with never-ending restrictions and ever-growing fees.

FREE Services included with all Complete Business Checking Accounts:

• No deposited checks or rolled coin fees

• No cash deposit fee

• Online banking with bill pay

• Mobile banking with check deposit

• Unlimited checking writing

• Business VISA® Debit Card

• Over 55,000 surcharge-free ATMs4

• Select from dividend earning, no monthly fee, or non-profit

To learn more about Connex Business Checking, Click Here

To Open a Business Checking Account Call us at 1-800-CR-UNION or stop by a branch today.

1 - APR = Annual Percentage Rate - A 7.49% APR is representative of a 36-month personal loan and the monthly payment would be $31.10 for each $1,000 borrowed. Annual Percentage Rate includes a 0.25% rate discount for our Grand Opening special and a 0.25% rate discount with Auto Pay from a Connex Credit Union checking account. Other rates and terms are available upon approved credit. Programs, rates, terms, and conditions are subject to change at any time and may be withdrawn without notice. The rate you pay will be determined by the term of the loan, your credit history, and other factors. All loans are subject to credit approval, underwriting guidelines, and membership eligibility. Other terms and conditions may apply. The minimum loan amount is $2,000 and the maximum loan amount is $20,000. Refinancing existing Connex loans is not eligible. Offer effective from March 15, 2024 to April 15, 2024.

2 - Offer available to individuals who never had a Connex checking account. The new checking account must be opened during the promotional period (3/15/2024-4/15/2024), and remain open in order to receive any earned Bonus. Bonus will be posted within 90 days of qualifications being met. Cannot be combined with other offers including a discount on a loan annual percentage rate. If your checking account is closed within six months after opening, we will deduct the bonus amount at closing. You can only receive one new checking account-related bonus per member. Bonus is considered income and will be reported on IRS Form 1099-Int. To qualify for the bonus you must have a minimum direct deposit, or check deposit of $350 or more per statement cycle for two consecutive months and must be completed by June 30, 2024. Direct Deposit must be an electronic deposit of your paycheck, pension, or government benefit (such as Social Security) from your employer or the government. Person-to-person and transfers from other financial institutions to your new Checking account do not qualify.

To join Connex you must live, work, worship, or attend school in Hartford, Middlesex, New Haven, or Fairfield County and deposit $25 in your Share Savings account. Unless otherwise specified, all offers and rates advertised are subject to change without notice, and may be withdrawn at any time. Other terms and conditions may apply go to connexcu.org for full account disclosures.

© 2025 Connex Credit Union.

.png)